Proactive financial fraud prevention not only helps minimize losses but also plays a critical role in maintaining seamless customer experiences and improving overall operational efficiency.

As fraud schemes become increasingly sophisticated, faster, and larger in scale, traditional control measures are no longer sufficient. Financial fraud prevention is therefore no longer merely a matter of compliance or security – it has become a strategic priority that enables organizations to optimize processes and ensure sustainable growth.

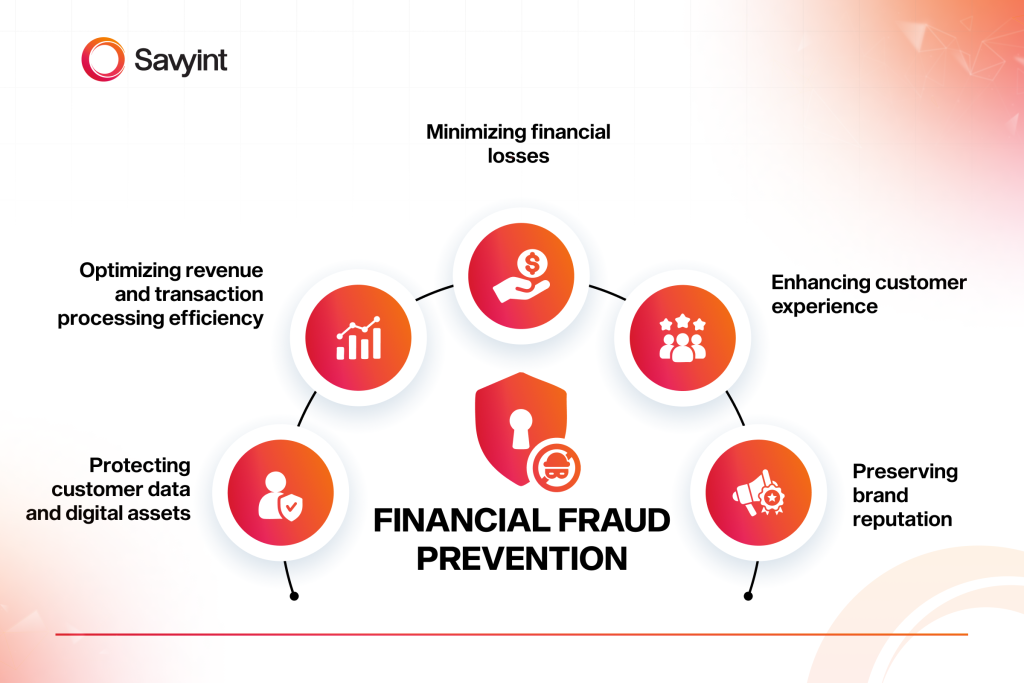

1. Benefits of Financial Fraud Prevention

Implementing robust fraud prevention measures not only safeguards customers and organizations but also supports long-term, sustainable business growth.

a. Minimizing financial losses

Fraud can cause significant damage even when incidents occur on a small scale. Effective preventive measures help organizations reduce the risk of loss, control costs, and build a solid financial foundation for long-term development.

b. Optimizing revenue and transaction processing efficiency

One direct benefit is the improvement of authorization rates by reducing false declines of legitimate transactions – a common challenge in online payments. When transactions are processed accurately and quickly, completion rates increase, enabling businesses to maximize revenue.

c. Protecting customer data and digital assets

In the financial and banking sector, protecting personal information and financial data is essential to maintaining customer trust. Account Takeover (ATO) attacks and card data theft not only result in financial losses but also severely damage an organization’s reputation. By proactively preventing fraud, organizations can detect and stop these threats early, before real damage occurs.

d. Enhancing customer experience

Customers increasingly expect transactions to be smooth, uninterrupted, and free from unnecessary verification steps. Reducing fraud also means reducing unnecessary transaction rejections, leading to better customer experiences while lowering operational pressure and costs for businesses.

e. Preserving brand reputation

As noted above, even minor fraud incidents can erode customer trust and negatively impact brand image. Investing in comprehensive fraud prevention demonstrates a strong commitment to security and customer protection, helping organizations build a trusted and credible brand over the long term.

2. Effective Fraud Prevention with Savyint Fraud Prevention and Risk Management

With these benefits in mind, a comprehensive and effective fraud prevention system enables banks and financial institutions to minimize losses, strengthen transaction protection, ensure customer data security, and enhance long-term operational efficiency. This is precisely the objective of Savyint Fraud Prevention & Risk Management (FPRM).

Built on a Zero Trust architecture, Savyint FPRM enables organizations to proactively prevent fraud while integrating risk management and transaction security. The solution leverages AI and Machine Learning for behavioral analysis, combined with strong authentication mechanisms such as SCA, multi-layer MFA, and biometrics, along with advanced security technologies including tokenization and Post-Quantum Cryptography (PQC). This enables:

- Real-time fraud detection

- Risk scoring

- AI-driven advanced user authentication

- Comprehensive transaction monitoring

As a result, organizations can detect, prevent, and respond to fraud effectively before losses occur. Savyint Fraud Prevention & Risk Management (FPRM) also complies with global standards such as AML, KYC, KYB, PSD2, PSD3, and PCI-DSS, as well as local regulatory requirements including Circulars 64 and 50 (Vietnam), BSP 1213 (Philippines), and regulations in Malaysia.

Connect with Savyint experts today for detailed consultation on a fraud prevention roadmap tailored to your organization’s business model!