Savyint has officially announced the launch of its Open Banking Tech Stack, marking a significant milestone in the journey of building an open and inclusive financial ecosystem in Vietnam and across the region.

As the global financial industry undergoes a strong transformation towards open finance models, implementing open banking is no longer just a trend but a strategic imperative for financial institutions to maintain competitiveness. The growing demand for connectivity between financial ecosystems – including banks, enterprises, and end-users – requires an infrastructure that not only complies strictly with regulatory frameworks but also ensures the highest level of data security and privacy.

With this vision, Savyint introduces the Open Banking Tech Stack – a comprehensive solution designed to help banks, financial institutions, and enterprises accelerate digital transformation, foster innovation, and contribute to shaping an open and inclusive financial ecosystem.

Open Banking Tech Stack – Bridging Technology and Compliance

The Open Banking Tech Stack is designed to strictly meet both regulatory and technological requirements, enabling banks and financial institutions to enhance connectivity, collaboration, and innovation within a globally integrated system.

Key Advantages of the Open Banking Tech Stack:

- Maximum risk reduction with top-tier global security frameworks such as eIDAS, FIDO, PQC

- Compliance with international open banking standards, including Berlin Group, UK Group, Singapore, Australia, Hong Kong…

- Extended functionality beyond open banking, leveraging the full potential of open API infrastructure for Open Finance, Open Government, Open Healthcare, powered by a Microservice-based architecture.

- Flexible and adaptable to the diverse needs of organizations and enterprises in Vietnam.

The Open Banking Tech Stack equips organizations with a complete set of tools to implement a modern open banking system, including:

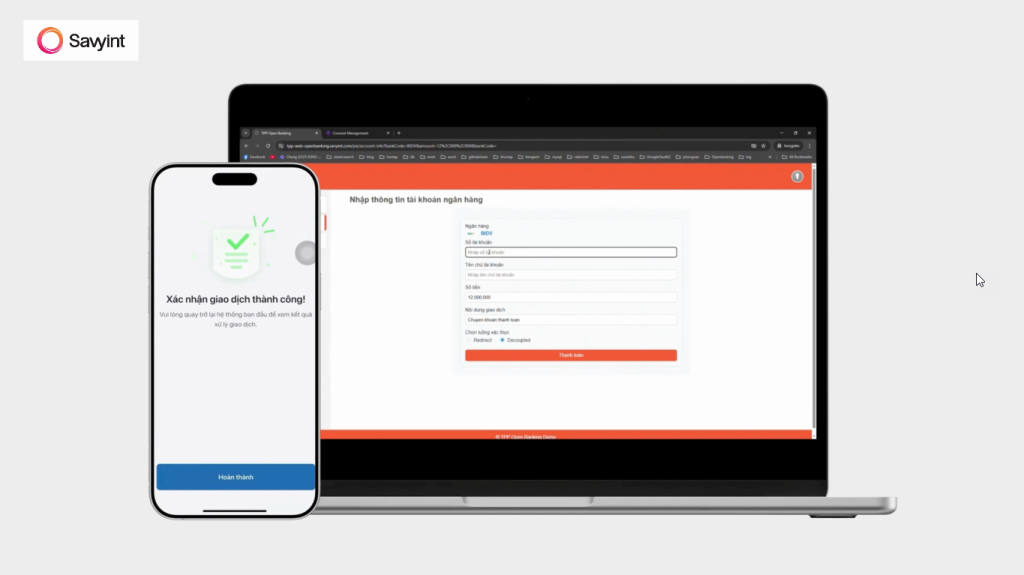

In addition, the Tech Stack integrates seamlessly with secure online payment gateways, creating a complete end-to-end process for banks and third-party providers – from registration, identification, authentication, integration, and data sharing to payments.

Strategic Partnerships with Global Technology Leaders

Savyint’s Open Banking Tech Stack is built on strategic collaborations with world-leading names in Open API and Open Banking, including Red Hat, Axway, Tyk.IO, Kong, Curity, Salt Group, IBM, Google Cloud, Gravitee, Fiorano, and Open Banking Exchange.

Through these partnerships, Savyint not only delivers cutting-edge technology solutions but also provides customized adaptability to meet the specific needs of each market – ensuring reliability, optimal security, and exceptional scalability.

The Open Banking Tech Stack is expected to break down traditional barriers, enabling intelligent data sharing and close collaboration among stakeholders. This fosters healthy competition, drives innovation, and lays the foundation for a new era of inclusive finance.

Don’t stand outside the open banking movement, connect with Savyint experts TODAY!