Open API plays a pivotal role in the digital transformation of the financial and banking sectors. It drives innovation in traditional banking, promising secure, efficient financial transactions that meet every customer need.

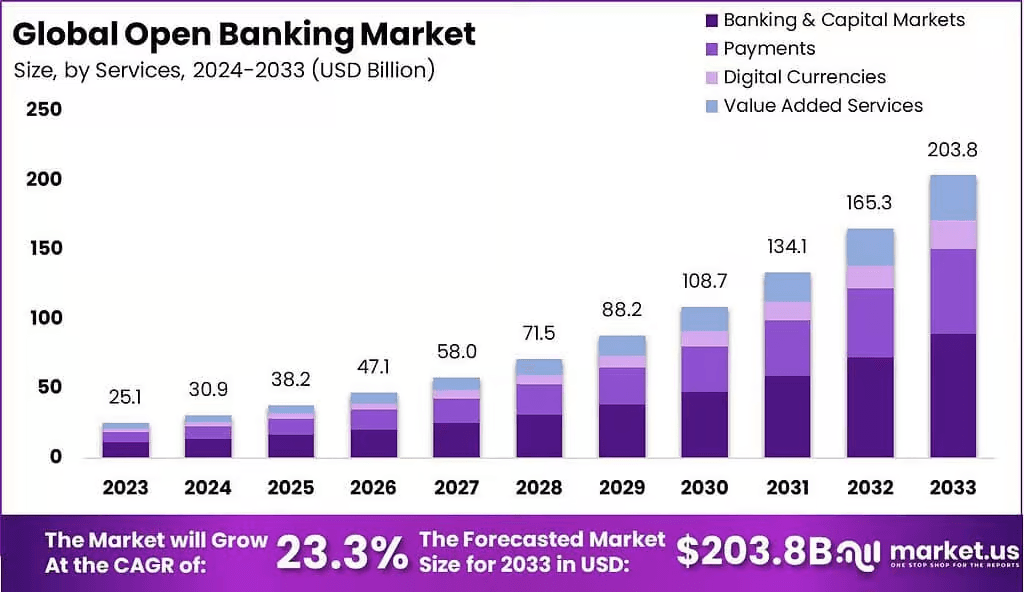

1. Open Banking and Open API market could exceed $200 billion by 2033

Open banking represents the evolution of a new financial ecosystem based on connections between banks, financial institutions and third-party service providers, supported by APIs. Through this ecosystem, banks can offer customers superior and more flexible services, while enabling better personal financial management and decision-making.

Although still relatively new, banks and financial institutions are actively engaging in the open banking ecosystem. According to reports and forecasts from Market.us, the global open banking market is expected to grow steadily over the years, reaching $203.8 billion by 2033.

On January 13, 2018, the European Union’s Payment Services Directive (PSD2) came into effect, requiring banks to grant third parties access to customer accounts via available APIs, provided customers give consent. By using APIs, third parties can access banking data, enabling trusted banks and service providers to serve customers more effectively.

Since the advent of PSD2, the payments sector has undergone a true technological revolution, notably with the rise of open banking and open APIs. These developments have fueled banks’ efforts to innovate and transition from traditional to new business models. Open banking and open APIs offer banks opportunities to create new services, personalize offerings, and enhance customer experiences.

Read more: Open API – The key to promoting open banking

2. Benefits of applying Open API in Open Banking

- Enhanced customer experience: The key to sustaining strong customer relationships lies in providing secure, rapid access to account data. Open API enables banks to support diverse services for customers at any time of day, unrestricted by conventional banking hours. Improved customer experience helps retain clients and attract new partners.

- Opportunities for new products and services: Banks and their partners can collaborate to create new products and services for customers. Alternatively, each party can offer unique features that combine to deliver added value.

- Strengthened service delivery: Banks are not just API providers but also consumers. They enhance their products and services by integrating APIs from partners to develop internal fintech solutions.

- New revenue streams: Beyond enhancing services and customer engagement, open banking APIs enable banks to generate revenue through new digital technologies.

- Integration of internal systems and third-party applications: Each bank may use hundreds of applications simultaneously to operate, and the challenge is that these applications cannot always “communicate” with one another. Open APIs allow these apps to easily and quickly integrate with other services and data sources, amplifying the value of core systems and third-party apps.

- Increased automation: Finding ways to minimize manual operation time is a top priority for every bank and other organizations. Open API helps organizations automate tasks and processes, reduce time, and thereby enhance efficiency and productivity.

- Enhanced security: APIs support security measures such as authentication and authorization to protect data and systems. This not only prevents unauthorized access but also safeguards critical banking information.

3. Challenges of applying Open API in Open Banking

Despite the benefits, applying Open API in open banking comes with challenges. Overcoming these is crucial to ensure the sustainability and security of open banking initiatives based on Open API.

- Integrating legacy systems with new technology:

Many banks and financial institutions still use infrastructure and technologies developed years ago. These legacy systems often aren’t compatible with modern API solutions, making integration difficult. Upgrading such systems demands significant technological investment, time, and resources. - Data security and legal compliance:

Expanding data access via APIs increases the risk of data breaches and cyberattacks. Banks must ensure APIs are built with robust security measures and comply with strict national regulations—such as Vietnam’s Personal Data Protection Decree or Europe’s GDPR—including data encryption, tight access controls, and regular security audits. - Achieving consensus among stakeholders: Open banking requires close collaboration between banks, third-party providers and regulatory authorities. Sometimes, differences in interests and objectives can lead to conflicts and delays in API implementation.

While Open API offers immense potential for the open banking ecosystem, participants must address technical, security, governance, and collaboration challenges to fully unlock its benefits.

4. Open API application in Savyint Open Banking: Comprehensive Open Banking Solution

4.1. Savyint partners with global leaders in providing Open API and Open Banking solutions

On the journey to conquer the era of open banking, Savyint has been collaborating with international giants in Open API and Open Banking to deliver advanced, secure solutions tailored to the specific requirements of each market. Notable partners include Brankas, SaltGroup, Konsentus, Curity, Axway, TykIO, and others.

- Brankas

Brankas is currently one of the world’s leading Open Banking solution providers, particularly in the Asia-Pacific and Middle East regions. With an extensive network of connections to banks and financial institutions across Southeast Asia, Brankas focuses on payment solutions and API-based connectivity for financial products.

Savyint and Brankas work closely to provide solutions related to Open API, user authentication and consent management in compliance with international standards, and to develop a Banking-as-a-Service (BaaS) platform that helps build and expand the Open Banking ecosystem in the region.

- SaltGroup

Salt Group is recognized as a trusted security solutions provider for banks, financial institutions, and government agencies in Australia and the Asia-Pacific (APAC) region.

Savyint partners with SaltGroup to enhance the security and trustworthiness of its Open Banking ecosystem. Leveraging SaltGroup’s strengths in strong authentication, fraud prevention, and digital identity management, the collaboration focuses on strengthening the security of open financial transactions, ensuring regulatory compliance, and protecting customer data in the digital banking environment.

- Konsentus

Savyint has joined forces with Konsentus — a global brand in open banking consultancy and infrastructure — to co-develop operational principles, service models, and regulatory frameworks for open banking in Vietnam.

Through working sessions, both parties will jointly build a set of principles to guide the operation of Vietnam’s open banking ecosystem, establish operational processes for technology deployment, and develop technical specification documents.

- Curity

Curity is a leading provider of API-driven identity management solutions, delivering comprehensive security for digital services.

Curity’s strength lies in its advanced CIAM solutions with multi-factor authentication (passkeys, digital wallets), SSO, adaptive authentication, and FAPI 2.0 protection, helping to enhance user experience and ensure data security in open financial transactions.

By integrating Curity’s pioneering technologies, Savyint is gradually modernizing the banking sector, strengthening security, and improving the user experience.

- Axway and TykIO

Axway and TykIO are long-established global technology companies specializing in API integration and management solutions.

Partnering with Axway and TykIO provides Savyint with the opportunity to build a comprehensive API management and integration system within the open banking ecosystem, rapidly deploy infrastructure, and ensure security, safety, and strict compliance with both domestic and international standards and regulations.

With innovative solutions and strategic partnerships, Savyint is committed to offering the most advanced technologies and optimal user experiences.

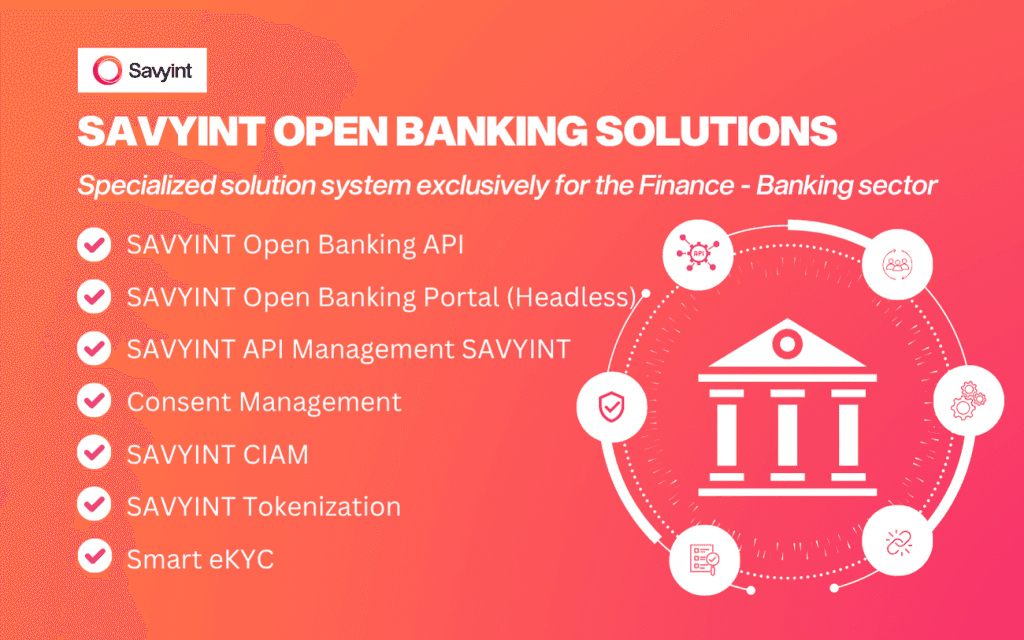

4.2. About Savyint Open Banking Solution

The Savyint Open Banking Platform is a specialized solution designed by Savyint for the financial and banking sector, meeting legal and technological requirements to connect and build a digital financial ecosystem.

The solution focuses on enhancing and optimizing APIs through SAVYINT Open Banking API — ensuring seamless connection with all systems and providing standardized, ready-to-use APIs — and SAVYINT API Management — supporting the development, analysis, operation, and expansion of APIs.

At the same time, SAVYINT Open Banking also emphasizes portals, consent management, user identity, and data security through the synergy of solutions such as:

- SAVYINT Open Banking Portal (Headless) – A central portal that enables third-party providers to register, access, and use open banking services.

- SAVYINT Consent Management – Collects, manages, and tracks user consent for the collection, use, and sharing of personal data.

- SAVYINT CIAM – Manages and secures customer identities.

- SAVYINT Tokenization – Prevents sensitive data leaks.

- Smart eKYC – Enables remote, paperless identity verification.

With solid technological infrastructure and operational expertise, Savyint delivers advanced technology and the best user experience to customers.

Connect with Savyint experts now to gain a leading edge in open banking.