According to a report by Toptal, 90% of users abandon an application if they face difficulties while using it. Therefore, user experience (UX) is always a top priority for service providers—especially in the Open Banking ecosystem, where UX plays a key role in attracting and retaining customers.

What are User Experience (UX) and User Interface (UI)?

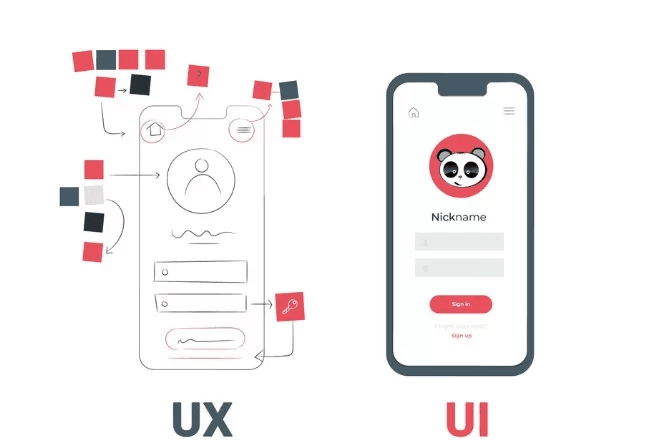

User Experience (UX) refers to the overall experience a user has with a product, website, mobile application, or specific service. It encompasses not only the use of features but also other aspects such as the user’s knowledge, emotions, and the value derived from interacting with the product, website, application, or service. A good UX enables users to navigate, operate, and engage with a product or service effortlessly. Conversely, a poor UX results in difficulties, complex operations, and confusion for users.

User Interface (UI) refers to the layout, images, videos, colors, fonts, text, and navigation buttons—elements that users can visually perceive and interact with when using a website or application.

User Experience in the Open Banking

In the Open Banking ecosystem, user experience typically encompasses the entire customer journey when interacting with an application—from registration, shopping, payments, renewals, to post-sale support. These applications are built on open APIs, enabling seamless integration of various services and features. As a result, users can perform transactions such as deposits, transfers, or payments without repeatedly entering card or account information. Additionally, third-party payment initiation service providers (PISPs) can execute transactions on behalf of customers, delivering a convenient, secure, and consistent experience across the system.

How to Improve User Experience in Open Banking?

There are several ways to enhance user experience in Open Banking. Below are some fundamental suggestions for organizations to implement:

- Simplify: Avoid overwhelming users with excessive information or features in an application. Focus on the most critical features and ensure they are easy to find and use.

- Enhance Accessibility: Accessibility features support users with hearing, vision, or reading limitations. Organizations should consider developing clear navigation, understandable information, and intuitive user interfaces to improve accessibility.

- Ensure Transparency: Open Banking concepts may still be complex for users. Providing transparent information and guiding customers on how to control and manage their banking data fosters trust and creates a positive user experience.

- Maintain Consistency: Ensure a consistent interface and user experience across the entire application, from account registration screens to transaction confirmation screens.

- Provide Logical Navigation: Simplify navigation to help users easily find what they need. Developers should create clear, logical navigation structures, intuitive menus, and user-friendly journeys.

- Use Clear Language: Language is a critical factor affecting user experience. Prioritize simple, familiar terms. For example, use “account balance” instead of “financial status” or “total assets,” and “transaction history” instead of “logs/stored transactions.”

- Customer Support: As Open Banking is still a relatively new concept for many users, provide comprehensive resources such as guides, videos, and documentation to help customers understand it better. Organizations can start by creating a dedicated FAQ section or a ticketing system for issue reporting. Ensure the contact page is easy to find and accessible in all scenarios.

- Enable App-to-App Navigation: App-to-app navigation involves redirecting users from one application to another when accessing data or functions from a different app. Participants in the Open Banking ecosystem often use this feature to ensure a seamless customer experience.

User experience (UX) is a critical factor in the success of Open Banking solutions. A great UX stems from simplicity, transparency, and logical navigation. Enhancing accessibility, using user-friendly language, and prioritizing customer support are excellent strategies for organizations to improve user experience.

About Savyint Open Banking Platform

Savyint is a global technology leader pioneering Open Banking, data security, and cybersecurity. With exceptional expertise in strategic consulting, technical architecture design, standards development, and integration workflows for Open Banking, combined with extensive experience in deploying electronic identification, digital signing, data encryption, and Public Key Infrastructure (PKI) systems, Savyint supports financial institutions, banks, government agencies, and enterprises in their secure and efficient digital transformation journey.

In building a modern Open Banking ecosystem, Savyint has developed the Open Banking Platform—a comprehensive solution that fully meets legal, technical, and operational requirements, from standardized APIs and connection gateways to TPP management, consent, encryption, and user identification. The platform comprises core solutions:

- SAVYINT Open Banking API: Seamless integration with all systems, providing standardized and ready-to-use APIs

- SAVYINT Open Banking Portal (Headless): A portal enabling third-party providers to register, access, and utilize Open Banking services

- SAVYINT API Management: Supports building, analyzing, operating, and scaling APIs

- SAVYINT Payment HSM: Ensures secure payment processing

- SAVYINT Managed PKI: Manages Public Key Infrastructure for secure digital signing

- SAVYINT TPP Management: Manages third-party providers effectively

- SAVYINT Consent Management: Collects, manages, and tracks user consent for data collection, usage, and sharing

- SAVYINT CIAM: Manages and secures customer identities

- SAVYINT Tokenization: Prevents sensitive data leakage

- Smart eKYC: Enables remote user identification

Connect with Savyint’s experts HERE to start your Open Banking strategy!