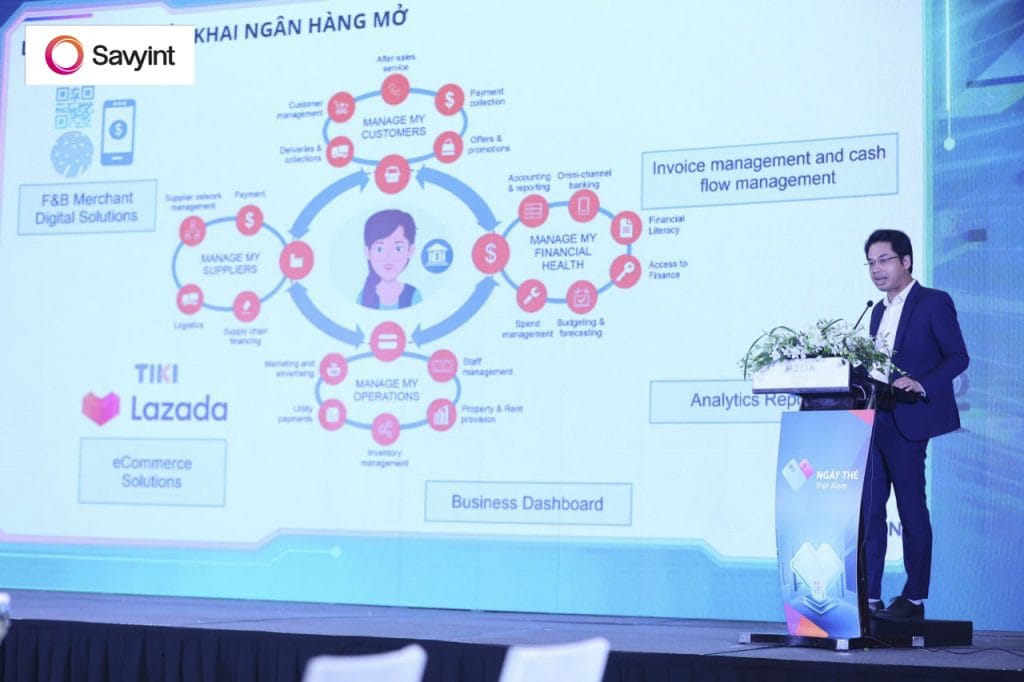

On the morning of October 2nd, Mr. Hoang Nguyen Van, Vice Director of the Institute of Innovation and Digital Transformation (VIDTI) and Chairman of the Board of SAVYINT, delivered a presentation on the topic “The Benefits and Challenges of Implementing the Open Banking Ecosystem” at the symposium.

The “Hanoi – Smart City and Open Banking Ecosystem” symposium was part of the 2024 Vietnam Card Day event series. It saw the participation of the Hanoi City leadership, Deputy Governor of the State Bank of Vietnam, and leading representatives from the financial and banking sectors, coming together to discuss and exchange ideas for a smart, clean, and digital Hanoi.

Speaking at the symposium, Mr. Ha Minh Hai, Vice Chairman of the Hanoi People’s Committee, emphasized that in the context of international integration and the development of the fourth industrial revolution, building a smart Hanoi is both essential and urgent. This forms the foundation for improving residents’ quality of life, optimizing urban management, and achieving sustainable, green, inclusive development.

Mr. Pham Tien Dung, Deputy Governor of the State Bank of Vietnam, shared similar views, stating that the transition to a smart city and digital transformation in the banking system are closely intertwined, with the emergence of the open banking ecosystem being a key factor. This transformation is linked to the integration of technology platforms, payment solutions, and data sharing to develop a strong digital and open banking ecosystem.

Following this, Mr. Hoang Nguyen Van elaborated on the advantages open banking brings and the challenges faced in its implementation in Vietnam.

According to Mr. Van, in recent years, as the trend of digital banking has grown, banks have increasingly sought to acquire new customers, reduce operational costs, and foster innovation. These needs have given rise to a new ecosystem—open banking. Third parties have emerged to help banks solve challenges related to increasing customer acquisition, improving service quality, and optimizing ecosystem integration at the most efficient costs.

In the open banking ecosystem, all participants benefit. Banks and third parties gain new revenue streams by leveraging each other’s strengths, which in turn fosters the development of innovative products and services. Individual users enjoy personalized services and enhanced data security, while businesses benefit from easier access to banking services, expanded customer and partner networks, and optimized operational efficiency.

Despite the numerous benefits, implementing open banking in Vietnam still presents challenges. While Vietnam has introduced personal data protection regulations (Decree 13/2023/ND-CP) and the State Bank of Vietnam’s regulations (Decision 2345/QD-NHNN), there is still a lack of clear standards on technical requirements, open API connectivity, and operational guidelines. After highlighting countries like India, Singapore, and South Korea, which have successfully implemented open banking through strong legal frameworks, Mr. Van stressed, “Only a clear legal framework can create favorable conditions for the open banking ecosystem to thrive and benefit all stakeholders.”

Concluding his presentation, Mr. Van proposed a four-step implementation model for banks, starting with initial analysis and assessment, deployment models (legal framework, service models, templates), application of rules and processes, and finally, design and technical standards. This model serves as a guide for banks participating in the open banking ecosystem.

Throughout the two working sessions, SAVYINT representatives and experts discussed various issues related to urban management, technology solutions, and enhancing the legal framework for the open banking ecosystem. Building a smart city requires more than technology and expertise—it also demands government support in terms of institutions, laws, and management methods. Particularly in a large city like Hanoi, with its extensive economy and population, these challenges must be carefully considered to ensure comprehensive development.

With a wealth of experience both domestically and internationally, SAVYINT continues to research and provide cutting-edge technology solutions in the fields of digital transformation, information security, and fintech. In the emerging field of open banking, SAVYINT offers specialized Open Banking Solutions and Services tailored to the financial sector, meeting both legal and technological requirements while fostering connectivity and building a digital financial ecosystem.

With its expertise and technological capabilities, SAVYINT is confident in supporting and advancing open banking in Vietnam.