The open banking ecosystem is developing strongly with significant and positive impacts on global finance; it is time for the world to witness the next chapters of open finance and open data.

In fact, open banking emerged quite by chance. Previously, in the UK, when fintech companies were just entering the retail payment market, there were no specific regulations on how to collaborate or manage when parties were involved together. A study conducted by the UK Competition and Markets Authority (CMA) indicated that the retail banking sector in the UK was monopolized in this market. This research result created a push for the issuance of open finance regulations globally, aimed at improving competitiveness and economic development.

From there, the concept of open banking was born, with specific provisions outlined in the PSD2 directive of the European Parliament, while concepts such as Account Information Service Provider (AISP – aggregating user data from multiple accounts) and Payment Initiation Service Provider (PISP – providing inter-account payment services) were also clearly defined.

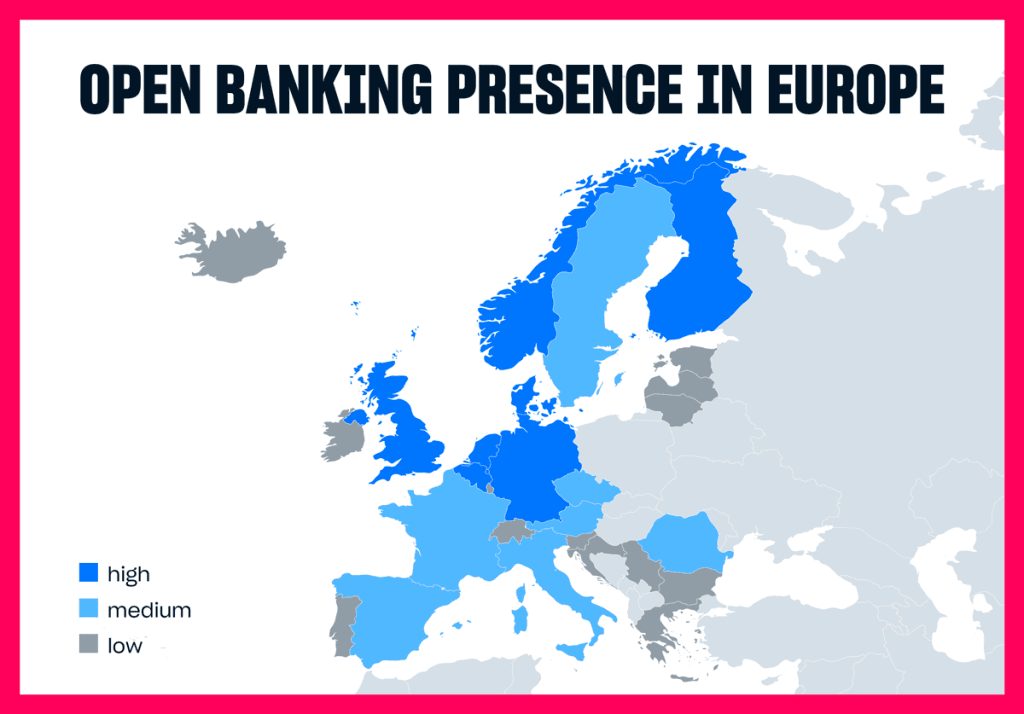

The emergence of open banking encourages banks to invest in API technology and develop partnerships with fintech organizations across Europe. Among them, Nordic banks were the first institutions to enthusiastically embrace this concept.

Not all open banking models are the same

When looking at the big picture, banks in the Nordic region have ample opportunities and technology to develop an open banking ecosystem thanks to the advancements of service providers as well as consumer acceptance. While in the Nordic countries, top banks fear losing customers and are quite quick to adopt advancements in open financial technology. Meanwhile, in the UK, users here are rather cautious due to fears of fraud, lack of personal data security, or unstable APIs, etc.

An important factor contributing to success in the Nordic countries is that banks have become third-party service providers (TPPs) themselves, rather than allowing more innovative competitors to capture market share. A case in point is Danske Bank, which operates in all four major markets in the Nordic region with a payment application launched in the first half of 2018, and throughout the year, the banking interface between consumers and sellers was truly refined. Danske also allows customers to make payments from other banks within its banking app. These rapid transformations are made possible by several specific factors in the Nordic region, including the decreasing use of cash and the development of digital identity technology in the Nordic countries.

In contrast to the Nordic region, at the same time in the UK, efforts to create open banking applications have not yet been widely accepted by users due to the barriers mentioned above. To overcome these barriers, the UK’s Open Banking Implementation Entity (OBIE) has created an app store for both users and businesses to search for and use financial services that complement their online bank accounts.

Laws are not barriers but are put in place to support businesses serving users

In many countries, the rapid development of technology outpacing legislation poses many challenges for both regulatory agencies and businesses: regulators struggle to establish an appropriate legal framework, while businesses face uncertainty about regulations, slowing down the process of delivering new services to consumers. However, the significant role of law in protecting users, safeguarding participants in the open banking ecosystem, and driving change and innovation cannot be denied.

As pioneering data aggregation organizations in Europe – MoneyHub (established in 2009, UK), Bankin (established in 2011, France), and Spiir (established in 2011, Denmark) – have developed strongly to date. These organizations and their customers are strong evidence that users believe in the benefits of transferring money between accounts and making payments regardless of which bank their accounts are with. Additionally, there are other data aggregators aiming to maintain competition, ensuring that these transaction methods truly help consumers save time and reduce costs.

In fact, when account aggregation apps added convenient payment features, the number of users increased exponentially. This shows the positive interaction between tech companies and regulators. In Northern Europe – where banks and fintech organizations have been ahead of regulators, leveraging APIs for a long time, not only for compliance with PSD2 regulations but also because these organizations want to create truly useful applications for users.

Digital identification promotes open finance and open data

In less transactional fields, such as the energy sector, digital identification helps accelerate the development of products and services as well as consumer adoption. Northern Europe is an example of applying digital identification in banking for commercial purposes. As a result, digital identification is quite commonly used in Northern Europe, helping to speed up the customer verification process; now, fintech companies not only compete with banks but can also compete with credit and debit card providers (who have weaknesses in storing customer information online).

Overall, organizations and businesses outside the financial-banking sector should use digital identification. Because digital identification helps accelerate progress in all fields.

Open data facilitates competition and drives innovation and creativity

After a period of implementation and acceptance, open banking has developed faster than initially anticipated. Now, users can request banks to provide transaction history, identification images, and other information to any bank or third party they wish. Users can also easily change accounts, apply for loans, or register for credit cards with new providers. Additionally, users can manage their financial history on a single platform, without wasting time switching between applications.

This journey is becoming increasingly attractive, as new players are also ready to join the “game.” In the future, organizations outside the financial sector will also use open data to provide highly personalized products and services based on users’ control over their own data. These “new players” will help users easily search for and be provided with necessary services that meet their needs. Any service that maximizes time and cost savings will succeed in the journey to win over users.

Open data – Opportunities for leaders

Accessing open banking and open finance from the perspective of regulators or users is not a problem that can be solved overnight, but rather a continuous and ongoing process. It will require even more attention as technological initiatives regarding open data emerge. In the future, for open data to create positive changes, clarity in regulations and legal standards is a prerequisite, necessitating collaboration from regulatory agencies as well as closer cooperation between countries to unify the standards that need to be met when exchanging data.

In conclusion, the whole world is witnessing the development and benefits that open banking brings. It is time for us to set additional goals in the era of open finance and open data. More time may be needed, but this is the driving force for developing the global economy and technology.

About SAVYINT and the SAVYINT Open Banking solution

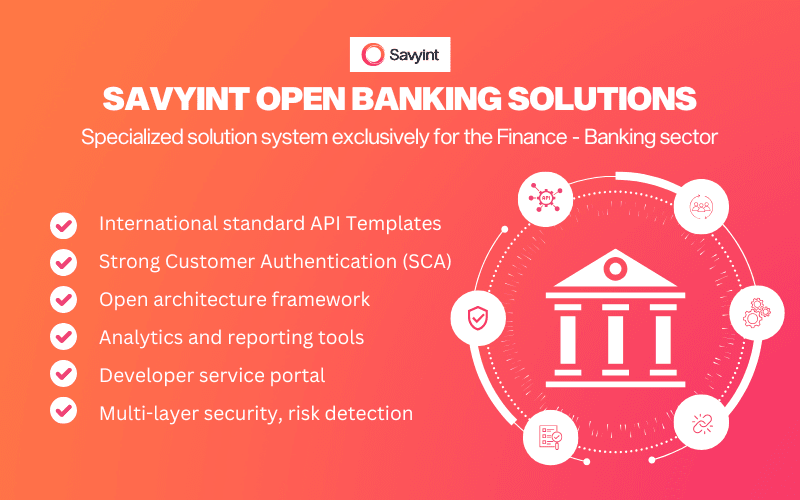

SAVYINT is a trusted service provider leading the market and is in the TOP 10 leading IT companies in Vietnam. SAVYINT has successfully developed the SAVYINT Open Banking solution – a specialized system dedicated to the Finance – Banking sector, meeting legal and technological requirements to create connections and build a digital financial ecosystem. With a solid technological infrastructure and experience in deployment and operation, SAVYINT provides customers with advanced technology and the best user experience.

The SAVYINT Open Banking solution encompasses all the features to become a reputable standard platform in the Finance – Technology field:

- International standard API Templates: Supports Open Banking technical standards from leading global organizations such as Berlin Group, UK Group, Monetary Authority of Singapore, Australian Competition and Consumer Commission, Hong Kong Monetary Authority, etc.

- Strong Customer Authentication (SCA): Supports strong authentication in electronic payments and transactions, adaptive authentication, and consent management according to GDPR.

- Open architecture framework: Allows for the flexible development and construction of services based on the Open Banking platform.

- Multi-layer security: Supports multiple layers of API security such as OAuth2, authentication using digital certificates according to eIDAS standards, ensuring absolute safety.

- Analytics and reporting tools: Provides analytics, reporting, and API statistics tools suitable for the operational needs of organizations and businesses.

- Developer service portal: Supports Dev/Test environments, facilitating development and testing.

- Easy and secure Core Banking integration: Ensures quick and absolutely secure integration with existing Core Banking systems.

- Risk detection: Provide risk analysis tools in transactions, detect counterfeit, abnormal, and unsafe characteristics.

Open banking applications are the key to accelerating growth in the financial sector. Connect with SAVYINT now to leverage and experience the features and benefits of open banking today!