Elevating security standards for online banking services in Vietnam

On October 31, 2024, the State Bank of Vietnam issued Circular No. 50/2024/TT-NHNN, establishing regulations on security and confidentiality for online banking services -marking a strategic step in building a robust legal foundation for Vietnam’s digital banking ecosystem. As digital banking services rapidly expand and cyberattacks and data breaches become increasingly common, the banking sector must continuously enhance safety, security, and transparency in all electronic transactions. Circular 50 replaces Circular 35/2016/TT-NHNN and meets the growing demand for higher security amid Vietnam’s strong digital transformation efforts. Effective from January 1, 2025, Circular 50/2024/TT-NHNN applies to credit institutions, foreign bank branches, intermediary payment service providers, and credit information companies. All online banking services must comply with stringent security standards to ensure safety for both banks and their customers. The Circular clearly outlines principles and technical requirements in the design, implementation, and operation of online service systems. Key highlights include: The tightened security standards under Circular 50/2024/TT-NHNN are not merely a legal compliance obligation, but a strategic advantage for banks in the digital age – building greater trust in online services. For credit institutions, the Circular provides strong motivation to invest in IT infrastructure, standardize operational processes, and gradually align with international standards such as PCI-DSS and ISO/IEC 27001- laying the groundwork for deeper integration into the global Open Banking movement. For customers, the Circular enhances trust in digital services and reduces risks associated with online transactions. At present, with the enforcement of Circulars 64 and 50, credit institutions are required to upgrade their systems to ensure stronger security at every level of service. In the long run, compliance with Circular 50 – along with adherence to international standards like PCI-DSS and ISO/IEC 27001, and alignment with strong customer authentication (SCA) requirements under PSD2/PSD3 in the EU—will help elevate Vietnam’s banking sector to global standards, promoting innovation and fostering fair competition.

Savyint & Kryptus: Collaboration to build open banking security standards

Open Banking is experiencing remarkable development in many countries. To ensure that open banking operates effectively and securely, it is particularly important to establish and adhere to a system of technical standards. With their expertise, Savyint and partner Kryptus have collaborated to develop a specific security standard system for each component in open banking. The API Gateway plays a crucial role in securing APIs by providing authentication, authorization, access control, and traffic limiting mechanisms. For the API Gateway, we ensure compliance with European and global regulations such as PSD2/PSD3, FAPI 2.0, CIBA, OIDC/OAuth2, and API Security. Meanwhile, Consent Management utilizes the Strong Customer Authentication (SCA) method as stipulated in PSD2, as well as security standards for key storage on HSM devices that meet FIPS 140-2 Level 3 or higher. The data exchange flows, data signing in transaction flows, or user data sharing are encrypted with the highest security level, ensuring integrity and safe authentication with JWS (JSON Web Signature) and JWT (JSON Web Token). End-to-end data encryption is also strictly adhered to with JWE (JSON Web Encryption) and RSA-PSS (Probabilistic Signature Scheme). In Vietnam, with the specific regulations for implementing open banking officially in effect, the standards set by Savyint and Kryptus fully comply with the regulations on Open API, API Security (according to Appendices 1 and 2 of Circular No. 64/2024/TT-NHNN), as well as regulations on transaction encryption, digital signing, and user authentication (according to Circular No. 50/2024/TT-NHNN). This is a promising market for the development of open banking in the near future. “We are proud to contribute our expertise in building a secure and regulation-aligned open banking ecosystem in collaboration with Savyint,” said Thierry Martin, Kryptus Managing Partner. “Kryptus has already achieved FIPS 140-2 Level 3 and the Common Criteria EAL4+ certification for HSM, strengthening our compliance across various global environments, as the fintech and banking sectors require enhanced key protection. Our joint solutions not only fully comply with European and international standards such as PSD2 and FAPI, but also with Vietnam’s specific regulatory frameworks, including Circulars 64/2024 and 50/2024. This partnership reflects our long-term commitment to helping financial institutions meet compliance obligations while accelerating digital transformation. We believe this collaboration will pave the way for broader regional adoption and global expansion of secure open banking models.” The swift, solid and well-directed steps taken by the two companies in providing a secure and safe open banking solution will be an advantage for Savyint and Kryptus to conquer markets in the region and globally. About Savyint SAVYINT is an IT security company in Sydney, Australia, with an R&D Center in Hanoi and international offices in Singapore, Dubai, Ho Chi Minh City (Vietnam), and Sofia (Bulgaria). With over 20 years of experience, we consistently rank among the leading global information technology enterprises, providing software platforms, system solutions, and services for digital transformation. Our expertise spans Open Banking solutions, information security, and FinTech, particularly in the Finance – Banking & FSI, Government, Manufacturing, Telecommunications, Healthcare, Education, and Media sectors. About Kryptus Kryptus is a Swiss and Brazilian multinational company specializing in cybersecurity and cryptography solutions. Since 2003 it has been delivering highly customizable, reliable and secure encryption and cybersecurity solutions. For over twenty years, we have served public and private sector clients in Latin America, Europe, the Middle East and Africa for critical applications, with the best level of products and services for mission-critical applications.

Open Banking takes flight in Vietnam

On December 31, 2024, the State Bank of Vietnam officially issued Circular No. 64/2024/TT-NHNN, setting the regulatory foundation for Open Banking through the implementation of Open Application Programming Interfaces (Open API) within the banking sector – a key driver of digital finance innovation globally. Open Banking is a new financial ecosystem in which banks and financial institutions allow third parties (fintech companies, financial service providers, etc.) to access customer data, with customer consent, to develop new services such as personal financial management, integrated payments, etc., through Open Application Programming Interfaces (Open APIs). Amid the rapid global development of Open Banking, in Vietnam, the State Bank of Vietnam issued Circular 64, effective from March 1, 2025, which is considered a legal tool paving the way for establishing a controlled, secure, and transparent data-sharing infrastructure, fostering innovation in the financial and banking sector. Key highlights in Circular 64: Accordingly, the Bank must comply with API security technical standards as stipulated in Annex 01 and Annex 02 issued with Circular 64/2024: These regulations have a profound impact on the development of Open Banking in Vietnam. Most crucially, they establish a clear and consistent legal framework for the secure and controlled connection, sharing, and processing of customer data, thereby laying the foundation for building innovative, personalized financial products and services. This enables the realization of comprehensive digital banking goals by allowing third parties to access user data with user consent. This is the key factor in forming an expansive, flexible, and customer-centric open banking ecosystem. Simultaneously, these regulations create significant opportunities for the Fintech community to engage more deeply in the financial ecosystem, enhancing the provision of new and innovative services. In the initial phase, financial institutions may face challenges in adapting. However, the issuance of Circular 64 fundamentally provides a robust legal foundation, serving as a springboard for building a modern Open Banking ecosystem in Vietnam, where data is leveraged and managed rigorously, with users at the center of all financial services.

Savyint eArchive BOX – An All-in-One electronic archiving solution for every organization

In the digital age, data is considered the “new oil” of the digital economy. Archiving is no longer just about preserving information but a strategic component in every organization’s operations. An effective electronic archiving solution enables organizations to build a solid infrastructure—from digitization and security to intelligent data exploitation. The current state of archiving in organizations Although many organizations are becoming aware of digital archiving, most still lack proper systems for digitization and electronic document management. Traditional methods prevail, such as printing documents for storage or saving them across personal hard drives, USBs, etc. This lack of synchronization leads to fragmented data management and several risks: In addition to risks from fragmented or traditional archiving, many organizations struggle with deploying electronic archiving solutions. International solutions may be powerful but costly and difficult to customize for Vietnamese business needs, while domestic solutions often fall short of ISO technical standards or recommended digital archiving architecture. Hence, the demand for a comprehensive, standards-compliant, easy-to-operate electronic archiving solution is growing across sectors. Savyint eArchive BOX – The All-in-One Electronic Archiving Solution As a leading archiving solution provider, Savyint is the first and only company to introduce Savyint eArchive BOX, designed in compliance with the international OAIS reference model (ISO 14721:2012) and Circular No. 02/2019/TT-BNV from the Ministry of Home Affairs regarding electronic archive data and preservation standards in Vietnam. Savyint eArchive BOX includes a full package: server, OS software, database software, integrated with digital signing and long-term preservation tools—allowing organizations to easily build an independent storage system for operation and integration. 2.1. Secure storage – Long-Term preservation – Efficient exploitation Savyint eArchive BOX is equipped with modern features to deliver three core objectives: a. Secure Storage b. Long-term Preservation c. Efficient Utilization 2.2. Multiple editions for every need Savyint eArchive BOX offers three flexible editions, tailored to organizations of all sizes and security/compliance requirements: Standard Advanced Premium Storage Capacity 5TB 7 – 10 TB 10TB++ Archiving staff accounts Free 5 accounts for archival staff Free 6–10 accounts for archival staff Free 10+ accounts for archival staff Digital certificates included Free 5 personal digital certificates and 1 organizational/business digital certificate for 3 years. Free 10 personal digital certificates and 1 organizational/business digital certificate for 3 years. Free 10+ personal digital certificates and 1 organizational/business digital certificate for 3 years. Access accounts Unlimited Unlimited Unlimited Digital signature software Electronic and digital signing using USB tokens. Supports integration with HSM Electronic and digital signing using USB tokens. Supports integration with HSM Includes digital signing with USB tokens, HSM, remote signing, and mobile signing. Supports advanced signing standards, timestamp embedding, and electronic authentication for long-term archiving. Document conversion tools Pre-integrated tool for converting Office documents and PDFs into formats suitable for storage and long-term archiving, such as PDF/A, TIFF,… Training & Support Guidance on digitization, data initialization, data standardization, data type creation, technology transfer,… Each version is designed for quick setup, clear access control, ease of use, and includes lifetime support to ensure seamless implementation. Connect with SAVYINT experts today to accelerate your digital archiving journey and move toward a paperless future with Savyint eArchive BOX.

Open API: Ushering in the era of Open Banking

Open API plays a pivotal role in the digital transformation of the financial and banking sectors. It drives innovation in traditional banking, promising secure, efficient financial transactions that meet every customer need. 1. Open Banking and Open API market could exceed $200 billion by 2033 Open banking represents the evolution of a new financial ecosystem based on connections between banks, financial institutions and third-party service providers, supported by APIs. Through this ecosystem, banks can offer customers superior and more flexible services, while enabling better personal financial management and decision-making. Although still relatively new, banks and financial institutions are actively engaging in the open banking ecosystem. According to reports and forecasts from Market.us, the global open banking market is expected to grow steadily over the years, reaching $203.8 billion by 2033. On January 13, 2018, the European Union’s Payment Services Directive (PSD2) came into effect, requiring banks to grant third parties access to customer accounts via available APIs, provided customers give consent. By using APIs, third parties can access banking data, enabling trusted banks and service providers to serve customers more effectively. Since the advent of PSD2, the payments sector has undergone a true technological revolution, notably with the rise of open banking and open APIs. These developments have fueled banks’ efforts to innovate and transition from traditional to new business models. Open banking and open APIs offer banks opportunities to create new services, personalize offerings, and enhance customer experiences. Read more: Open API – The key to promoting open banking 2. Benefits of applying Open API in Open Banking 3. Challenges of applying Open API in Open Banking Despite the benefits, applying Open API in open banking comes with challenges. Overcoming these is crucial to ensure the sustainability and security of open banking initiatives based on Open API. While Open API offers immense potential for the open banking ecosystem, participants must address technical, security, governance, and collaboration challenges to fully unlock its benefits. 4. Open API application in Savyint Open Banking: Comprehensive Open Banking Solution 4.1. Savyint partners with global leaders in providing Open API and Open Banking solutions On the journey to conquer the era of open banking, Savyint has been collaborating with international giants in Open API and Open Banking to deliver advanced, secure solutions tailored to the specific requirements of each market. Notable partners include Brankas, SaltGroup, Konsentus, Curity, Axway, TykIO, and others. Brankas is currently one of the world’s leading Open Banking solution providers, particularly in the Asia-Pacific and Middle East regions. With an extensive network of connections to banks and financial institutions across Southeast Asia, Brankas focuses on payment solutions and API-based connectivity for financial products. Savyint and Brankas work closely to provide solutions related to Open API, user authentication and consent management in compliance with international standards, and to develop a Banking-as-a-Service (BaaS) platform that helps build and expand the Open Banking ecosystem in the region. Salt Group is recognized as a trusted security solutions provider for banks, financial institutions, and government agencies in Australia and the Asia-Pacific (APAC) region. Savyint partners with SaltGroup to enhance the security and trustworthiness of its Open Banking ecosystem. Leveraging SaltGroup’s strengths in strong authentication, fraud prevention, and digital identity management, the collaboration focuses on strengthening the security of open financial transactions, ensuring regulatory compliance, and protecting customer data in the digital banking environment. Savyint has joined forces with Konsentus — a global brand in open banking consultancy and infrastructure — to co-develop operational principles, service models, and regulatory frameworks for open banking in Vietnam. Through working sessions, both parties will jointly build a set of principles to guide the operation of Vietnam’s open banking ecosystem, establish operational processes for technology deployment, and develop technical specification documents. Curity is a leading provider of API-driven identity management solutions, delivering comprehensive security for digital services. Curity’s strength lies in its advanced CIAM solutions with multi-factor authentication (passkeys, digital wallets), SSO, adaptive authentication, and FAPI 2.0 protection, helping to enhance user experience and ensure data security in open financial transactions. By integrating Curity’s pioneering technologies, Savyint is gradually modernizing the banking sector, strengthening security, and improving the user experience. Axway and TykIO are long-established global technology companies specializing in API integration and management solutions. Partnering with Axway and TykIO provides Savyint with the opportunity to build a comprehensive API management and integration system within the open banking ecosystem, rapidly deploy infrastructure, and ensure security, safety, and strict compliance with both domestic and international standards and regulations. With innovative solutions and strategic partnerships, Savyint is committed to offering the most advanced technologies and optimal user experiences. 4.2. About Savyint Open Banking Solution The Savyint Open Banking Platform is a specialized solution designed by Savyint for the financial and banking sector, meeting legal and technological requirements to connect and build a digital financial ecosystem. The solution focuses on enhancing and optimizing APIs through SAVYINT Open Banking API — ensuring seamless connection with all systems and providing standardized, ready-to-use APIs — and SAVYINT API Management — supporting the development, analysis, operation, and expansion of APIs. At the same time, SAVYINT Open Banking also emphasizes portals, consent management, user identity, and data security through the synergy of solutions such as: With solid technological infrastructure and operational expertise, Savyint delivers advanced technology and the best user experience to customers. Connect with Savyint experts now to gain a leading edge in open banking.

Open Banking: A driving force for SME growth

Small and medium-sized enterprises (SMEs) are vital to the economic development of any nation, playing a key role in creation and contributing significantly to national budget revenues. However, access to finance remains a persistent challenge for SMEs in many countries. The advent of open banking is expected to break down many financial barriers that SMEs face. The outstanding benefits of Open Banking for SMEs Open banking not only benefits banks, third-party providers and end-users, but it also delivers significant advantages to SMEs. Improved access to credit SMEs often struggle to obtain credit from traditional banks due to factors such as lack of audited financial reports, insufficient collateral or unclear financial data,… Open banking allows SMEs to securely share their financial data with third-party providers capable of assessing credit history. This creates better opportunities for SMEs—especially startups or those with limited credit history—to access financing from a variety of financial institutions. Enhanced financial management Through open banking, SMEs can access a wide range of financial products and services from different providers on a single platform. Business owners can view all accounts, transactions, and financial data in one dashboard or app, empowering them to make smarter financial decisions and manage cash flow more effectively. More competitive pricing Another positive impact of the open banking ecosystem is the increased price competition for financial products and services. By leveraging the financial data of SMEs, credit institutions can offer financial products that are tailored to the specific needs, size, and sector of each business. This means that SMEs can access the most suitable loan packages available to them. Stronger security and data privacy To participate in open banking, banks and third-party providers must comply with strict security standards set by international and national regulations. This ensures that SMEs’ financial data is kept safe, private and protected from unauthorized access. Practical tips for SMEs joining Open Banking Understand Open Banking Before joining the open banking ecosystem, it is essential for SMEs to fully understand the nature and how open banking works. Organizations and SMEs can start by reading articles, watching explainer videos, and participating in webinars. It is also valuable to connect with other business owners who have already embraced open banking and learn from their experiences. The more knowledge SMEs gain about open banking, the better equipped they will be to make smart and informed decisions. Choose a Trusted third-party provider When entering the open banking ecosystem, SMEs will need to select a third-party provider to manage their financial data. The selection should be based on clear criteria: review the provider’s list of partners, existing clients, and past projects. SMEs can start right away by researching information on company websites, reading customer reviews, and seeking recommendations from businesses that have worked with these providers. Prioritize data security Data security should be a top priority when participating in the open banking ecosystem. SMEs must ensure their financial data is protected from unauthorized access or theft by verifying that the chosen third-party provider complies with data protection and information security regulations and standards. Start small and scale gradually The technical requirements, infrastructure, and data-sharing demands of open banking can feel overwhelming for SMEs. Therefore, it is advisable to begin with basic services—such as integrating payment solutions—and then gradually expand to more complex offerings like lending and credit services. This approach helps businesses stay in control and gradually adapt before moving to full-scale integration. Joining open banking marks a significant turning point for SMEs. It not only provides access to better financial products and services but also enables more efficient financial management. To maximize the benefits of open banking, SMEs need to be well-informed, choose reliable providers, and prioritize data security. By following these best practices, SMEs can fully leverage open banking’s advantages, ensuring stable growth without concerns over funding challenges. About SAVYINT and the SAVYINT Open Banking Solution SAVYINT is a global technology company with strong expertise in open banking, data security, and protection across key sectors such as financial services, government, manufacturing, telecommunications, healthcare, education, and media. With extensive hands-on implementation experience, SAVYINT has launched a comprehensive Open Banking solution that fully meets legal and technological requirements to connect and build an open banking ecosystem. The solution includes: Connect with SAVYINT’s experts today to kick-start your open banking strategy!

SAVYINT GROUP Shares Insights on Digital Trust at Vietnam – Asia DX Summit 2025

At the workshop “Enhance DX: Expanding Market Scale – Promoting Cooperation”, held as part of the Vietnam – Asia DX Summit 2025, SAVYINT GROUP delivered deep and insightful perspectives on Digital Trust: establishing trusted services, strong identity and authentication frameworks, and safeguarding user privacy in an increasingly digital world. On May 27 in Hanoi, the Vietnam – Asia DX Summit 2025, chaired by the Vietnam Software and IT Services Association (VINASA), officially kicked off under the theme: “Mastering Technology – Breakthroughs for Progress.” Spanning two days, the summit welcomed over 2,500 attendees, including leaders from government bodies, industry experts, and representatives from technology firms in Vietnam and 16 countries and economies across the region. With 9 focused workshops, more than 100 speakers, and engaging discussions, the event addressed key policy bottlenecks within Resolution No. 57-NQ/TW (December 22, 2024) and Resolution No. 68-NQ/TW (May 4, 2025) issued by the Politburo. It also spotlighted digital transformation, technology renewal, digital infrastructure development, green and smart production, AI, digital data resources, and regional collaboration amid rapid technological changes and shifting geopolitical landscapes. At the workshop “Enhance DX: Expanding Market Scale – Promoting Cooperation”, Mr. Hoang Nguyen Van, Founder & CTO of SAVYINT GROUP, delivered an impactful presentation on Digital Trust – a foundational pillar for creating a safe, secure, and reliable digital environment for both users and institutions. Digital Trust – Building User Confidence in People, Technology, and Processes “Digital Trust is the confidence users place in people, technology, and processes to build a safe digital world,” Mr Van emphasized. He also pointed out that Digital Trust is not merely a technological requirement but a strategic foundation for constructing a transparent, secure, and responsible digital ecosystem—a vision closely aligned with Resolution No. 57-NQ/TW, which positions digital transformation and innovation as the core of national development. However, he noted that according to PwC’s 2025 Global Digital Trust Insights, only 2% of organizations worldwide have implemented Digital Trust at scale—revealing a gap and a golden opportunity for forward-thinking enterprises to leverage Digital Trust as a competitive advantage. To establish Digital Trust, Mr. Van outlined that organizations must build a comprehensive, multi-layered security foundation including: Digital Identities (for people, devices, applications, and systems); Data (structured, unstructured, and semi-structured) and Cryptography, using PKI (Public Key Infrastructure) and digital certificates to encrypt and protect information. He emphasized, “PKI plays a central role in the Digital Trust ecosystem, enabling secure data encryption, digital signing, and ensuring data integrity in all online interactions.” Mr. Van also illustrated how a secure Digital Trust infrastructure can support cross-border identity and payment ecosystems, with practical applications in various sectors such as hotel bookings, e-check-ins, telecom identity verification, e-contract signing, and healthcare authentication. SAVYINT – A Pioneer in Building Digital Trust in Vietnam As a trailblazer in digital identity and trust services, SAVYINT proudly stands as the first organization in Vietnam to receive QTSP (Qualified Trust Service Provider) certification under the European Union’s eIDAS regulation—the highest international standard for trusted digital services and electronic signatures. This achievement not only confirms the technological capability, compliance, and reliability of SAVYINT’s solutions but also reinforces its ability to develop independent, sovereign, and globally aligned Digital Trust infrastructures in Vietnam. One of the key strategic solutions highlighted by SAVYINT in this presentation is the Enterprise Security Appliance — an all-in-one security solution built into a single hardware device, integrated with a Hardware Security Module (HSM). This appliance enables organizations and enterprises to encrypt data, implement electronic identification (eID), establish a dedicated PKI infrastructure, perform remote digital signing, and manage the issuance, renewal, and revocation of digital certificates. Enterprise Security Appliance – All in a Box features flexible modules such as: Tokenization, Digital Authentication, eID, PKI (CA, VA, TSA); Remote Signing, Data Encryption, SCA/FIDO2, End-to-End Encryption; Data Privacy, Transaction Signing. The solution is compact, portable, easily deployable, and seamlessly integrates with existing IT systems. It can be fully tailored or scaled based on the specific needs of each enterprise and evolves alongside technological changes. Moreover, every component that constitutes the Enterprise Security Appliance—including both hardware and software—along with its operational governance framework, is rigorously designed to meet the highest international standards for security, protection, and legal compliance: Designed as a dedicated on-premise Digital Trust hub, SAVYINT empowers customers to build customized Enterprise Security Appliances with only the necessary functionalities—offering complete autonomy and optimal cost-efficiency without third-party dependency. Through its participation in Vietnam – Asia DX Summit 2025, and its impactful contribution on Digital Trust, SAVYINT once again reaffirms its mission: to accompany Vietnam in mastering core digital technologies, creating breakthroughs, and rising confidently on the global digital transformation map.

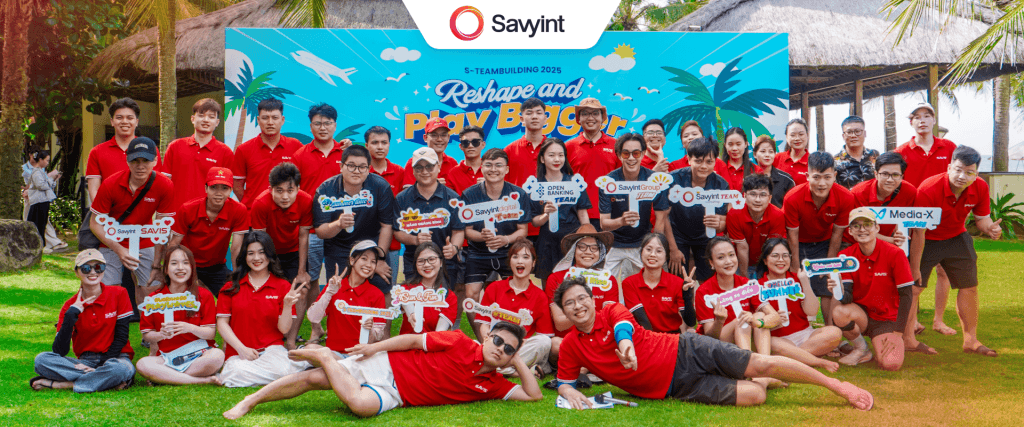

S-Team Building 2025: Reshape and Play Bigger

Against the backdrop of the sun-kissed, scenic Bao Ninh Beach at Sun Spa Resort, Quang Binh, S-Team Building 2025 officially kicked off—marking the start of a vibrant summer where the passionate hearts of every Savyer came together to reconnect, break through, and play bigger—in perfect alignment with this year’s theme: “Reshape and Play Bigger.” S-Team Building 2025 witnessed a fierce and thrilling battle among three legendary alliances, each unique and outstanding in their own way: King & Queen 2025 – Where Talent and Charisma Shine A signature highlight of every SAVYINT team building event, the King & Queen Contest, returned in full glory—celebrating the poise, intelligence, and charm of representatives from all three teams. After two dazzling rounds testing style and intellect, the coveted King & Queen 2025 titles were triumphantly claimed by: King – Mr. Le Thanh Quy and Queen – Ms. Nguyen Thi Thao Minh. This dynamic duo impressed judges and the audience alike with their flawless chemistry and confidence—leaving no room for doubt that they truly earned their crowns. Team Challenges – An Epic Chain of Games Right after the crowning moment, teams dived into a series of back-to-back, high-energy challenges designed to test both physical strength and coordination: Each challenge became a story of unity, effort, laughter, and teamwork. Ultimately, it was Team “Luôn Vui Tươi” who dominated with three back-to-back wins, earning the title of Game Champions. Gala Dinner – A Night of Talent, Gratitude, and Inspiration As the sun dipped below the horizon, SAVYINT’s Gala Dinner began—a heartwarming evening with the theme “Reshape and Play Bigger.” The event celebrated not just a year of hard work, but also charted a bold vision for the future. Key messages were delivered by Chairman Hoang Nguyen Van and Executive Vice President & COO Brad Palmer, emphasizing a transformative journey into the next financial year—with global aspirations and bigger goals ahead. The night also honored excellence through the S-Award 2025, recognizing long-time dedication and outstanding contributions. Savyers who’ve walked the 5-year journey with pride were honored with meaningful awards and sincere gratitude. SAVYINT remains committed to building not just technology and business, but also a culture that nurtures talent—encouraging a generation of proactive, critical-thinking, and passionate individuals ready to face every challenge. Contrasting the day’s intense games, the evening’s stage came alive with stunning performances that wowed the audience: Team “Lòng Xe Điếu” brought down the house with their charmingly humorous and clever skit, performed by the team’s “handsome stars.” It came as no surprise when they took home the Top Performance Award, scoring an impressive 90 – 95 – 100 from the judges. Team “Nắng Quảng Bình” delivered a joyful, creative act filled with vibrant neon lights, dazzling both the eyes and ears. Team “Luôn Vui Tươi” lit up the stage with a high-energy modern dance featuring the largest number of performers—bursting with unity, color, and laughter. After tallying scores from both the team challenges and the talent competition, the final results were: Champion: Luôn Vui Tươi – Runner-up: Lòng Xe Điếu – Third Place: Nắng Quảng Bình. Though S-Team Building 2025 has come to a close, its bright, meaningful memories will echo in every Savyer’s heart. More than just a trip, this was a milestone—a reset of spirit, a celebration of connection, and a bold step forward toward the larger game ahead – Reshape and Play Bigger. Thank you to every Savyer for creating such an unforgettable experience. See you on the next journey!

[Stablecoins Report] The Development of CBDCs Worldwide and in Vietnam – Part 4

Amid the rapid development of stablecoins and cryptocurrencies, many countries have begun researching, piloting, or deploying Central Bank Digital Currencies (CBDCs) to maintain the central bank’s dominant role in the monetary system. About CBDCs – Central Bank-Issued Digital Currency Central Bank Digital Currency (CBDC), often referred to as the digital money of the central bank, is a new form of central bank-issued legal tender in digital form. CBDCs use national units of account and are backed by central bank reserves. They are officially recognized and legitimized by central banks. CBDCs are introduced with the following objectives: Depending on their economic, technological, and financial conditions and strategies, countries have adopted different CBDC deployment models. The three main models are: Global CBDC Deployment According to the latest 2024 data from the Atlantic Council, 134 countries—representing 98% of global GDP—are exploring CBDC issuance, a fourfold increase from just 35 countries in May 2020. Among them, 66 countries have entered the development, pilot, or launch phases. Additionally, a BIS survey of 25 developed economies and 56 emerging/developing economies (covering 76% of the world’s population and 94% of global GDP) shows that over 90% of central banks are researching CBDCs, 62% have begun technical trials, and 26% are conducting pilot programs. Below are some notable countries that have piloted or implemented CBDCs: Bahamas Bahamas was the first country to officially launch a CBDC, the Sand Dollar, in October 2020, following pilots in the Exuma and Abaco islands in 2019. The Sand Dollar aims to improve financial inclusion, especially in remote areas where traditional banking services are inaccessible. The system uses Distributed Ledger Technology (DLT) developed by NZIA, a DLT and blockchain solution provider based in the Bahamas. It includes features like offline payments and transaction limits for lower-tier accounts to enhance security. After a hurricane in 2019, the Sand Dollar was deployed in Abaco to support economic recovery, highlighting the role of CBDCs in financial stability during crises. However, its adoption faces challenges due to uneven technological infrastructure and limited public acceptance. Nigeria Nigeria was the first African country to launch a CBDC, the eNaira, in October 2021. Although it aims to enhance financial inclusion and reduce transaction costs, eNaira adoption has been low—according to the IMF, by 2023, 98.5% of eNaira wallets had never been used. Key barriers include weak infrastructure, lack of public trust, limited product understanding, and competition from cash, mobile wallets, and cryptocurrencies. Despite this, the circulation of eNaira grew from 2.55 billion to 12.53 billion naira (around USD 8 million) by early 2024. The Central Bank of Nigeria (CBN) has started partnering with tech firms like Gluwa to improve infrastructure and plans to reassess its rollout strategy in 2025 to boost practical use. China China leads one of the largest-scale CBDC deployments with the e-CNY (digital yuan). Since 2020, e-CNY has been piloted in over 20 major cities and integrated into popular apps like WeChat and Alipay. A standout feature is offline payments, allowing transactions without internet access—crucial in remote areas. China uses a hybrid technological architecture, applying DLT only where beneficial. The country is also testing cross-border CBDC payments via the mBridge project with Thailand, the UAE, and Hong Kong. e-CNY is now accepted in retail stores and used for salaries and government benefits. However, as of May 2024, its cumulative transaction volume reached USD 910 billion—still modest compared to China’s total payment market of USD 40.3 trillion. Public concerns about surveillance have slowed widespread adoption, highlighting the need for privacy protections when implementing CBDCs. India The Reserve Bank of India (RBI) began piloting its retail digital rupee in four cities in late 2022. As of now, the rCBDC program has about 5 million users and has integrated standard QR codes for interoperability with other payment methods. Efforts are underway to introduce key features, including trials for usage in rural and remote areas. CBDCs are seen as tools for instant payments, reduced cash printing costs, and improved cash flow transparency and management. However, concerns remain over privacy, cybersecurity, and the impact on commercial banking systems. CBDC in Vietnam Vietnam has not issued a CBDC yet but has shown clear strategic interest. Since 2017, the Vietnamese government has introduced measures to manage the growing use of digital currencies through various regulations on digital assets, virtual currencies, and digital money. This effort has continued to evolve. In 2021, Decision No. 942/QĐ-TTg by the Prime Minister approved the strategy for developing e-government toward digital government, assigning the State Bank of Vietnam (SBV) to research and pilot CBDC from 2021 to 2023. In 2023, Resolution No. 50/NQ-CP emphasized the development of fintech, including blockchain and digital currency applications. SBV has formed dedicated research teams and collaborated with international organizations to explore suitable CBDC models. At the 5th Annual Meeting of the 7th Term of the Vietnam Banks Association on March 27, 2025, SBV Deputy Governor Pham Tien Dung announced Vietnam’s upcoming pilot of a digital asset trading platform. He emphasized the banking sector’s key role in protecting consumers, settling transactions, and ensuring the stability of stablecoin values. Additionally, the Ministry of Finance has submitted a draft resolution on piloting digital asset issuance and trading to the government. The plan includes coordination with the Ministry of Public Security and SBV to both foster market development and mitigate risks to financial security and monetary stability. According to Decree 94/2025/NĐ-CP on the regulatory sandbox for the banking sector, from July 1, 2025, the government will allow testing of new fintech-based financial products and services, including credit scoring, Open API data sharing, and peer-to-peer lending. These trial results will help regulators finalize a legal framework for fintech in Vietnam. This is a promising sign, paving the way for financial technology and digital currency development. CBDCs are an inevitable step in the global trend toward monetary digitalization. As seen in the case studies, there is no one-size-fits-all model for CBDCs. Each country must tailor its approach based on its specific economic and monetary conditions. While Vietnam has not yet issued a CBDC,

[Stablecoins Report] Risks, Challenges and Legal Framework of Stablecoins in Vietnam and Worldwide – Part 3

Stablecoins have emerged to reshape the way people transact, ushering in an era of digital finance that is fast and flexible. Alongside these benefits come risks and challenges that individuals and institutions alike must navigate—prompting countries around the world to quickly establish and refine legal frameworks to manage and develop this domain. Risks and Challenges of Stablecoins Despite their advantages, stablecoins carry significant risks and challenges for both users and the broader financial system. De-pegging and depreciation risks Although designed to maintain stability, stablecoins can lose their peg to reference values under certain conditions. This could be due to user panic and mass sell-offs, falling value of reserve assets (for crypto-backed types), or failure of operational algorithms (for algorithmic types). A notable example is the collapse of TerraUSD (UST) in May 2022. UST, an algorithmic stablecoin pegged to the USD via a mint/burn mechanism using the LUNA token, once reached a market cap of $18 billion. When confidence wavered, UST quickly lost its peg and crashed to nearly zero—causing tens of billions of dollars in investor losses. The “death spiral” not only destroyed UST/LUNA but also triggered a domino effect that led to the collapse of related funds and projects. Other stablecoins have also experienced de-pegging: Iron Finance’s IRON lost its value in 2021, USDT has temporarily dropped to $0.95 during market panic, and USDC fell to ~$0.88 in March 2023 due to reserve concerns before recovering. These incidents show that stablecoins are not “absolutely stable”—if reserve mechanisms are weak or unexpected events occur, stablecoins may crash in value, potentially resulting in total losses for investors. Risks in transparency and reserve assets For centralized (fiat-backed) stablecoins, trust in the issuer and reserves is paramount. A lack of transparency or failure to prove adequate reserves raises doubts. Tether (USDT) exemplifies this. For years, Tether faced criticism for not publishing independent audits, leading to concerns that USDT might not be fully backed by USD. Though Tether has since improved transparency (quarterly reserve reports) and claimed to hold ~$72.5 billion in U.S. Treasury bonds (as of Q2 2023), skepticism persists until a full audit is released. The quality of reserve assets is another issue: if reserves are invested in high-risk instruments (e.g., long-term bonds, low-quality commercial paper), market volatility can devalue reserves, threatening 1:1 redemption. Even reputable stablecoins like USDC were affected when ~$3.3 billion in reserves held at Silicon Valley Bank were frozen during its collapse—causing USDC to temporarily de-peg to ~$0.9. These cases highlight the necessity of high-quality, liquid reserves (cash or T-bills) to prevent systemic risk. As one expert said: “To avoid systemic risk, stablecoin reserves must be extremely safe and liquid.” Major events related to Stablecoins (2022–2023): Overall, the stablecoin market has undergone a “trust test”—well-reserved and transparent projects (like USDC) remained resilient, while weak or opaque ones were eliminated. Risks to the traditional financial system The rapid growth of stablecoins has raised concerns among regulators about systemic impacts. Large stablecoins like USDT and USDC hold massive reserves—Tether’s ~$72B in U.S. Treasuries is equivalent to a mid-sized bank or a major money market fund. A sudden stablecoin redemption wave (bank-run scenario) could force issuers to liquidate reserves, impacting money markets and traditional banking. Experts liken this to a looming “bank-run ghost” in crypto—without control, a widespread redemption event could destabilize both crypto and broader financial markets. Moreover, as private money issued outside central banks, stablecoins could divert deposits from commercial banks, weakening monetary policy tools and reducing banks’ lending capacity. A New York Fed report compares stablecoins to money market funds (MMFs): both aim to maintain a $1 value, but while MMFs are tightly regulated, stablecoins are not—posing potentially higher risks. There’s also concern that stablecoins may circumvent capital controls and AML/CFT regulations, allowing “hot money” to flow across borders unchecked. These concerns explain why regulators are on high alert and are pushing for stronger supervision frameworks to prevent systemic risks. In short, stablecoins are not risk-free. Users must understand each stablecoin’s mechanisms and credibility. Regulators must balance risk control (reserves, transparency, crime prevention) with innovation, as stablecoins can also benefit digital finance if properly managed. Legal landscape for Stablecoins in various countries Stablecoins straddle the line between currency and digital assets, prompting governments to explore legal frameworks. While approaches differ by country, the trend is toward increased oversight, ensuring reserves and reducing systemic risks. United States The U.S. has no unified federal law for stablecoins, resulting in fragmented regulation. The SEC considers some stablecoins securities, while the CFTC focuses on commodity-linked stablecoins (e.g., gold-backed). In 2021, the President’s Working Group on Financial Markets recommended regulating stablecoins like bank deposits. By 2023, draft federal legislation emerged (from the House Financial Services Committee) to set reserve and oversight requirements, but has not passed yet. Meanwhile, some states have acted: European Union (EU) The EU is a pioneer in digital asset regulation via the MiCA (Markets in Crypto-Assets) framework, adopted in 2023 and effective from 2024. MiCA categorizes stablecoins as: Requirements include: Oversight is shared between national regulators, ESMA (European Securities and Markets Authority), and the ECB for large stablecoins. MiCA limits the scale of non-euro stablecoins—if daily transactions exceed €200 million, usage may be restricted, preventing dominance by USD-backed coins. The EU aims to stabilize the stablecoin market and protect the euro. Major issuers like Circle are preparing to register under MiCA to continue operations in Europe. Singapore Singapore adopts a proactive, conditional approach to stablecoins. In 2022, the Monetary Authority of Singapore (MAS) stated that digital asset innovation is welcome—but not crypto speculation. Stablecoins, if well-regulated, could serve alongside CBDCs and tokenized bank deposits. In Aug 2023, MAS issued a regulatory framework for single-currency stablecoins (SCS) pegged to SGD or G10 currencies, issued in Singapore. Requirements include: Three entities (including Paxos and Circle via StraitsX) have received in-principle approval to issue compliant stablecoins—Singapore’s regulatory “sandbox” encourages innovation while ensuring safety. China China takes a strict stance on cryptocurrencies, including stablecoins. It has banned crypto trading, mining, and ICOs