Payment stablecoins are transitioning from peer-to-peer transactions to mainstream B2B and B2C payment applications, driving significant changes in traditional payment systems—an area traditionally dominated by banks. According to Deloitte, 2025 is poised to be the year of payment stablecoins.

1. What is a Stablecoin?

A stablecoin, as the name suggests, refers to a “stable” currency, meaning reliable, balanced, and secure. By pegging its value to fiat currency or gold, stablecoins maintain a stable price while leveraging blockchain’s decentralized nature, ensuring security and strict control.

Payment Stablecoins (PSC) are a specific type of stablecoin designed for payment purposes. They have the potential to enhance payment systems, reduce transaction costs, and promote financial inclusion. However, if not properly managed, they could also pose systemic risks.

2. The Growth of Stablecoins

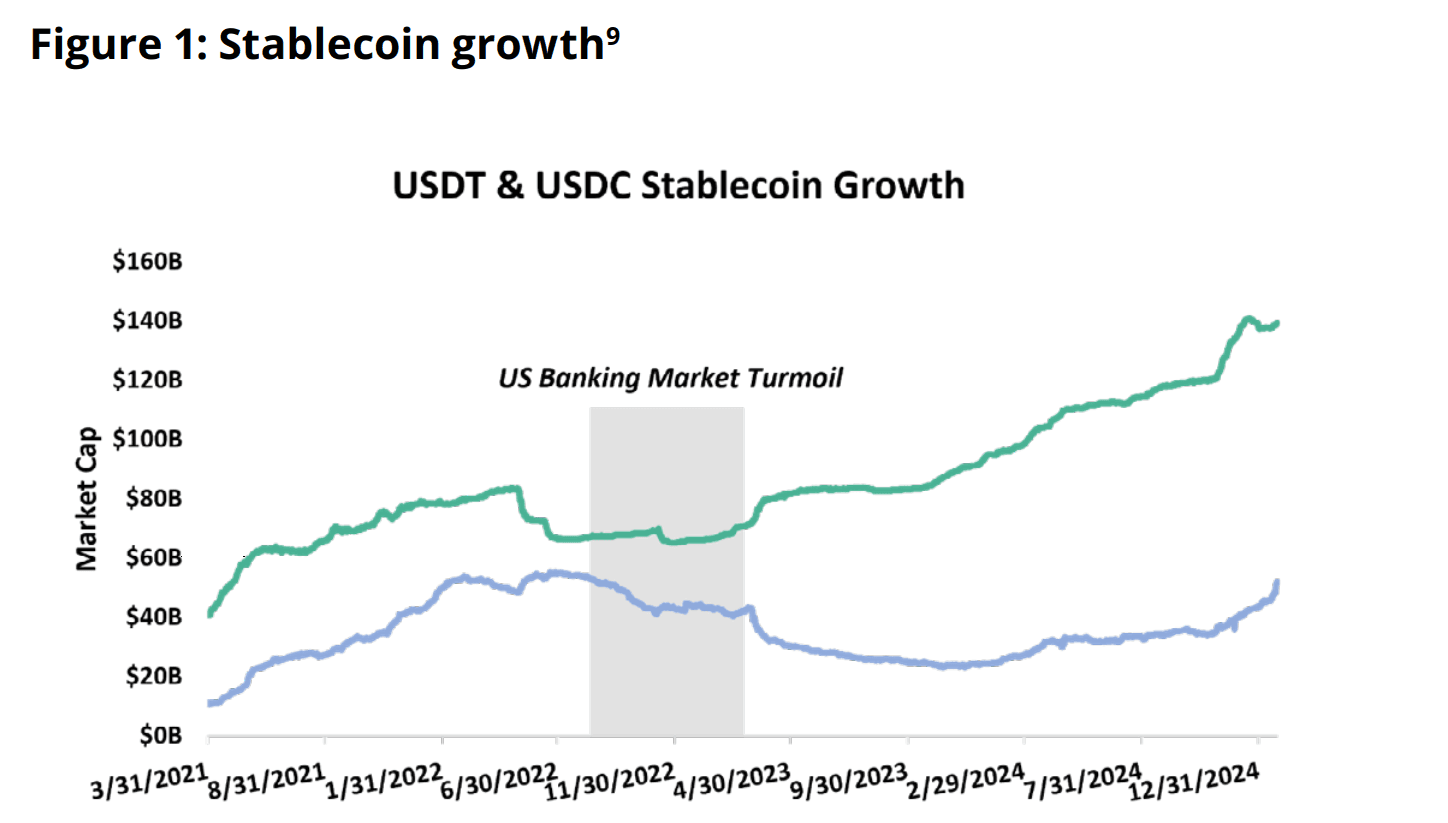

PSC has seen rapid growth in recent years, with market capitalization reaching hundreds of billions of USD. These stablecoins are widely used in cryptocurrency transactions, cross-border payments, and decentralized finance (DeFi).

3. Regulations and Policies

Governments worldwide are seeking to regulate PSC to ensure transparency and mitigate financial risks. Countries like the U.S., the EU, and Singapore have proposed new regulatory frameworks to oversee this market.

In the U.S., PSC issuance has primarily been driven by non-bank entities and crypto companies. However, the competitive landscape is shifting as the U.S. moves toward a clear and consistent national regulatory framework for PSC issuance. Looking ahead to 2025, various factors are encouraging traditional financial institutions (non-crypto firms) to consider becoming PSC issuers. These factors include the increasing market capitalization and transaction volume of fiat-backed stablecoins, signals from the new administration, regulatory agencies, and legislative developments in Congress aimed at establishing PSC regulations.

4. Trends in 2025

- Government-issued stablecoins (CBDC): Several central banks are exploring the issuance of digital currencies.

- Integration with banking systems: Stablecoins may gain wider acceptance in traditional finance.

- Stronger regulatory oversight: New regulations will help stabilize and sustain the market.

5. The Potential of PSC

PSC enables instant, low-cost payments, encouraging users to shift from traditional financial or payment systems to blockchain networks. Additionally, PSC mitigates the risks and volatility associated with non-fiat-backed cryptocurrencies (e.g., Bitcoin). With PSC market capitalization surpassing $200 billion, more businesses are developing platforms that facilitate PSC transactions.

To date, PSC market capitalization and trading volume have primarily stemmed from cryptocurrency and digital asset transactions. PSC has provided a stable medium of exchange, particularly during periods of market volatility. However, its applications are expanding beyond digital asset trading. PSC is now used for remittances and payments unrelated to digital assets, offering a faster and more cost-effective alternative to traditional financial systems. In many cases, PSC is being adopted as an extension or substitute for fiat currency.

For PSC to reach its full potential, further advancements are needed to overcome barriers in retail and commercial payments. This includes improving technological infrastructure and encouraging broader adoption by financial institutions, businesses, and consumers. By addressing these challenges, PSC can drive significant changes in global financial transactions, making them faster and more cost-efficient.

6. Risks of PSC

While PSC offers numerous opportunities, it also comes with significant risks that issuers must navigate, particularly as they operate in both traditional financial regulatory environments and the crypto ecosystem.

- Network Security and Data Protection: Cyberattacks can lead to PSC and private key theft, causing financial losses, legal risks, and a decline in user trust. Moreover, technological failures, such as blockchain network disruptions, can delay or prevent transactions. To mitigate these risks, issuers should implement strong security measures, including multi-factor authentication, regular vulnerability assessments, and comprehensive incident response plans. Infrastructure should also be designed for resilience and high transaction volume processing.

- Anti-Money Laundering (AML) Compliance: PSC issuers must adhere to stringent anti-money laundering (AML) regulations. Non-compliance could result in legal repercussions, including fines, operational restrictions, or even business shutdowns. To mitigate these risks, issuers should establish robust compliance programs, enforce strong AML and Know Your Customer (KYC) processes, conduct thorough customer due diligence, maintain detailed transaction records, and report suspicious activities to regulatory authorities.

- Blockchain and Smart Contract Risks: Reliance on blockchain technology and smart contracts presents unique vulnerabilities. Smart contracts may contain exploitable flaws, while blockchain networks may face issues like forks, congestion, or technical failures affecting transaction efficiency. To mitigate these risks, PSC issuers should continuously monitor and assess the reliability of their smart contracts and blockchain infrastructure, implementing comprehensive contingency plans.

- Stablecoin Devaluation Risk: A major risk associated with PSC is its potential devaluation when it fails to maintain its peg to the underlying asset (e.g., 1:1 ratio with USD). Devaluation can result from improper minting, burning, or reserve management. To minimize this risk, issuers should maintain stringent controls to ensure accurate minting and burning processes while effectively managing reserves.

- Operational and Market Risks: PSC issuers also face operational risks, such as human errors or internal fraud, which could undermine PSC stability and credibility. Additionally, market risks—including fluctuations in the value of reserve assets—may impact PSC stability. To address these challenges, issuers must implement strong internal controls, risk management frameworks, and robust governance structures.

Despite these challenges, payment stablecoins continue to grow rapidly and hold the potential to become a crucial financial instrument in the global economy due to their widespread usability and low-cost transactions. 2025 could mark a significant turning point for PSC in terms of market capitalization, transaction volume, and regulatory developments. The market awaits new developments with anticipation.

Source: Deloitte